Bank Complaints BRD

Oct 14, 2025

Background

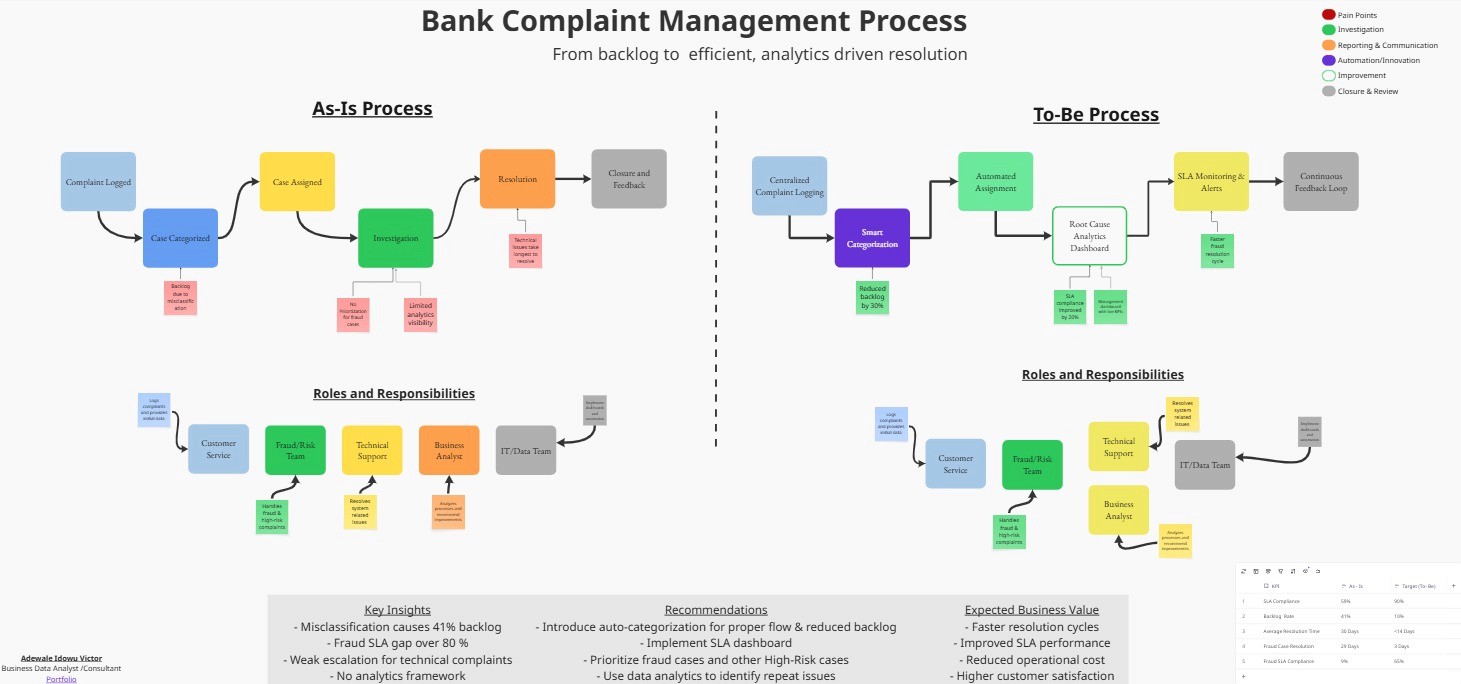

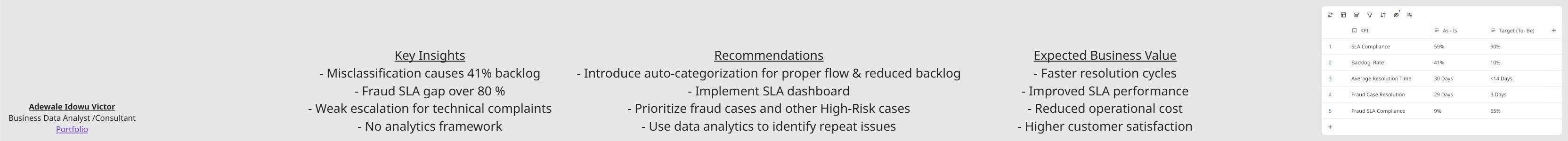

The bank has experienced a high volume of unresolved customer complaints, with significant SLA gaps, backlog accumulation, and poor resolution efficiency. This project aims to identify root causes and propose process and analytical improvements to enhance customer satisfaction and operational performance.

Business Objectives

• Improve complaint resolution time by at least 20% • Reduce backlog volume and SLA violations • Strengthen fraud escalation and prioritization processes • Improve customer experience and retention in the retail segment.

Project Scope

In Scope

• Analysis of complaints data • Process mapping of complaint resolution flow • Root cause analysis for delays • Strategy recommendations for process optimization

Out of Scope:

• System re-engineering • New CRM deployment

4. Stakeholders

Role | Responsibility |

|---|---|

Operations Head | Approve process improvements |

Customer Service | Implement workflow changes Review fraud-related SLAs |

Risk & Fraud Team | Review fraud-related SLAs |

Data Analytics Unit | Provide and visualize complaint data |

Current Process Overview (As-Is)

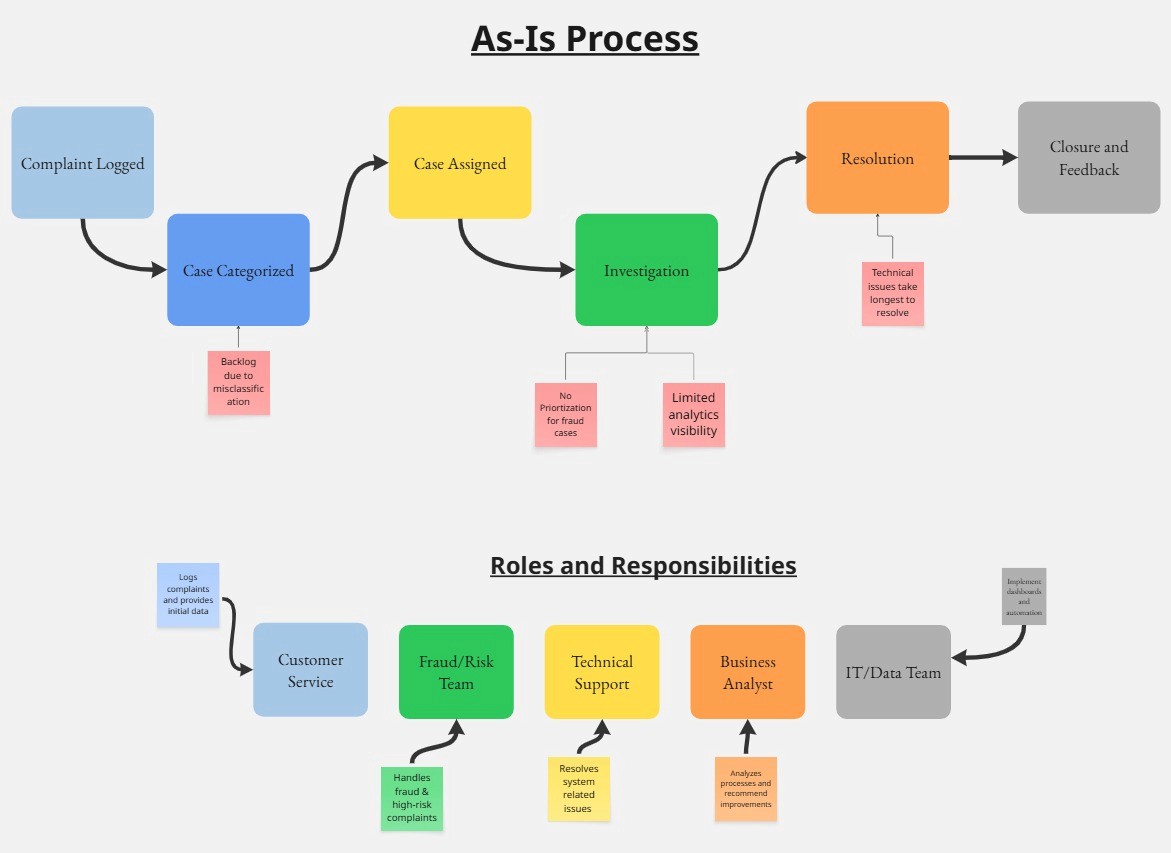

Provide and visualize complaint data Customers submit complaints via call center, email, or branch. Complaints are logged manually or through CRM. Tracking and escalation rely on periodic checks, leading to slow resolution and poor visibility of high-risk cases.

Key Pain Points

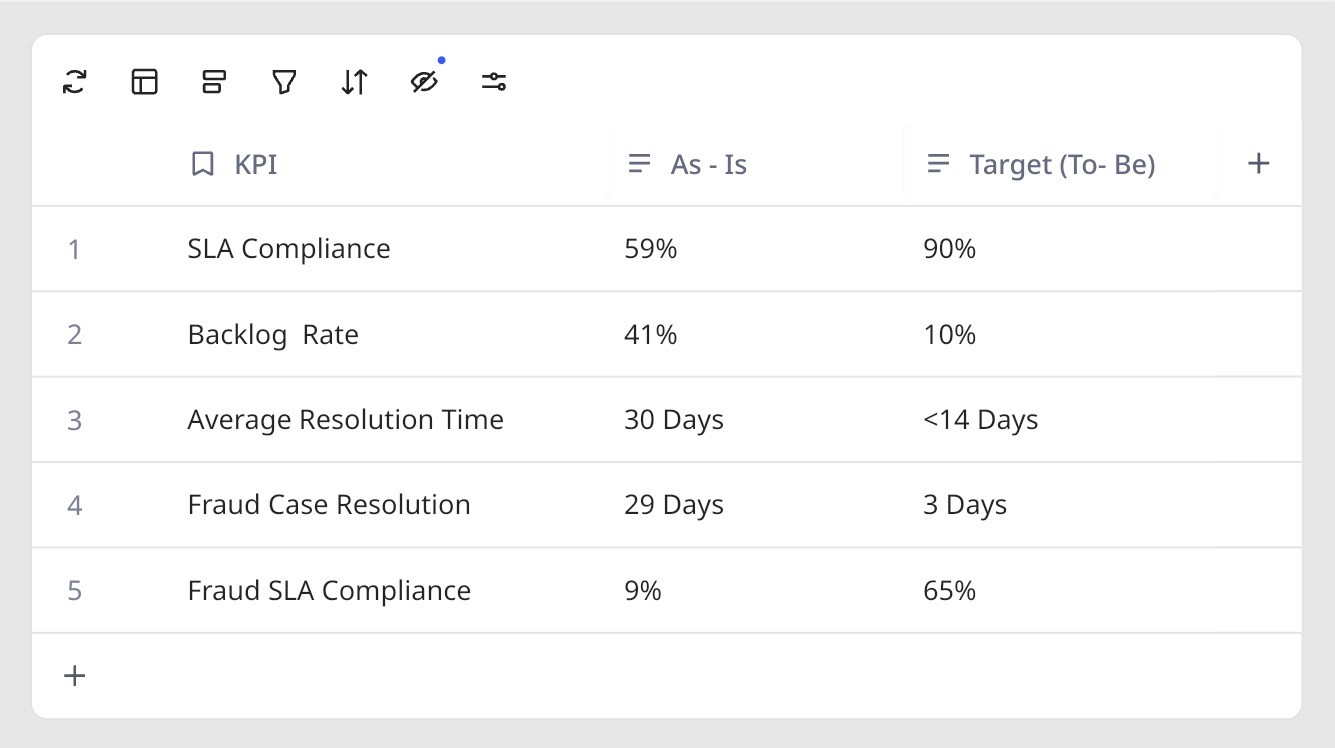

• 41% unresolved complaints backlog • Fraud related complaints SLA gap • Long resolution cycle for 'Technical' and 'Other' issues • Poor prioritization of high-risk fraud case • Use data analytics to identify repeat complaint causes. • Limited analytics or reporting to guide management decisions. • Manual complaint logging causes data entry errors and delays.

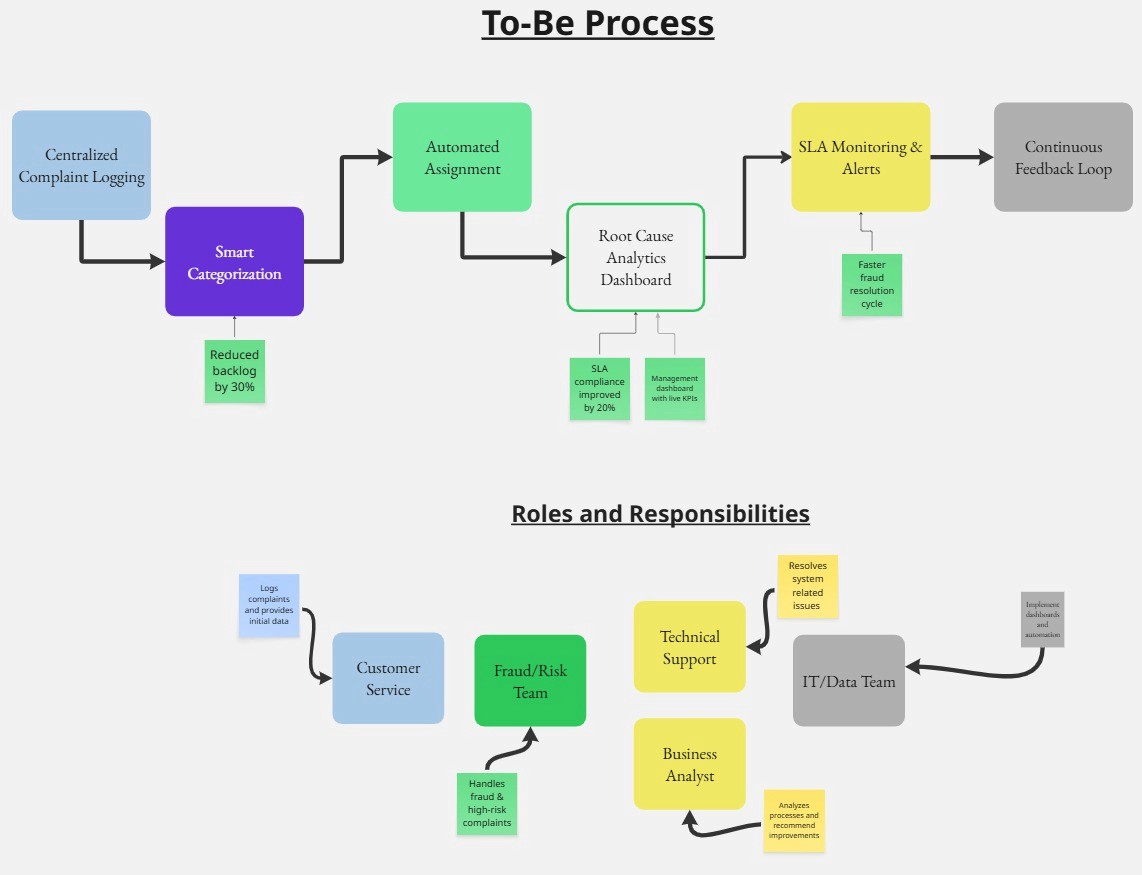

Proposed Solution (To-Be Process)

• Introduce automated SLA tracking dashboard (Power BI) • Implement risk-based priority flagging system • Redesign workflow for faster fraud escalation. • Automate complaint routing • Implement real-time SLA tracking and automated alerts • Enable auto-logging of complaints from multiple channels (email, branch, or web form) • Deploy interactive Power BI dashboards for live reporting • Leverage analytics to identify repeat complaint causes • Establish a continuous improvement loop

Functional Requirements

Requirement | Description |

|---|---|

R1 | Power BI dashboard to monitor SLA & backlog |

R2 | Automated alerts for overdue cases |

R3 | Weekly process performance report |

R4 | Fraud risk escalation rule (1–3 days turnaround) |

Success Metrics

• Resolution Time: < 35 days average

• SLA Compliance: ≥ 90%

• Fraud Escalation: ≤ 3 days

• Customer Retention ($100k–$200k Band): +15% improvement

Expected Business Impact

• Increased customer satisfaction and loyalty.

• Enhanced regulatory compliance.

• Improved operational visibility and decision-making.

• Data-driven culture in complaint management.

Timeline

Phase | Duration | Deliverable |

|---|---|---|

Analysis | 1 week | Root cause findings |

Design | 1 week | Process map + solution proposal |

Implementation | 2 weeks | Dashboard & reporting |

Review | 1 week | Impact assessment |