Role

Supply Chain & Operations Analyst

Industry

Retail & E-Commerce

Duration

2 Weeks

View Live Dashboard

Project Overview

The analysis provides a critical business intelligence snapshot of SuperStore’s current performance, focusing on the significant margin compression occurring during a period of high volume growth. The primary focus is comparing Current Year (CY) metrics against Previous Year (PY) to confirm the 28% surge in orders and units sold. The core financial mandate is profit optimization, as high sales volume is not translating efficiently into profit due to critically low margins in key categories (Chairs: 1.15%) and underlying logistic inefficiencies (4-day average delivery time).

Process, Steps, and Methodology

The visual dashboards were generated through a precise Business Intelligence workflow designed for comparative analysis:

Data Ingestion and Cleaning (Power Query): Raw transactional data was ingested, with Power Query (ETL) was used for robust data cleaning, standardization of formats, and preparation of fields for accurate aggregation.

Model Building and Calculation (DAX): A relational data model was established where all Key Performance Indicators (KPIs) and comparative metrics were calculated using DAX (Data Analysis Expressions). DAX enabled the precise calculation of year-over-year growth figures and the conditional logic for the CY vs. PY comparison.

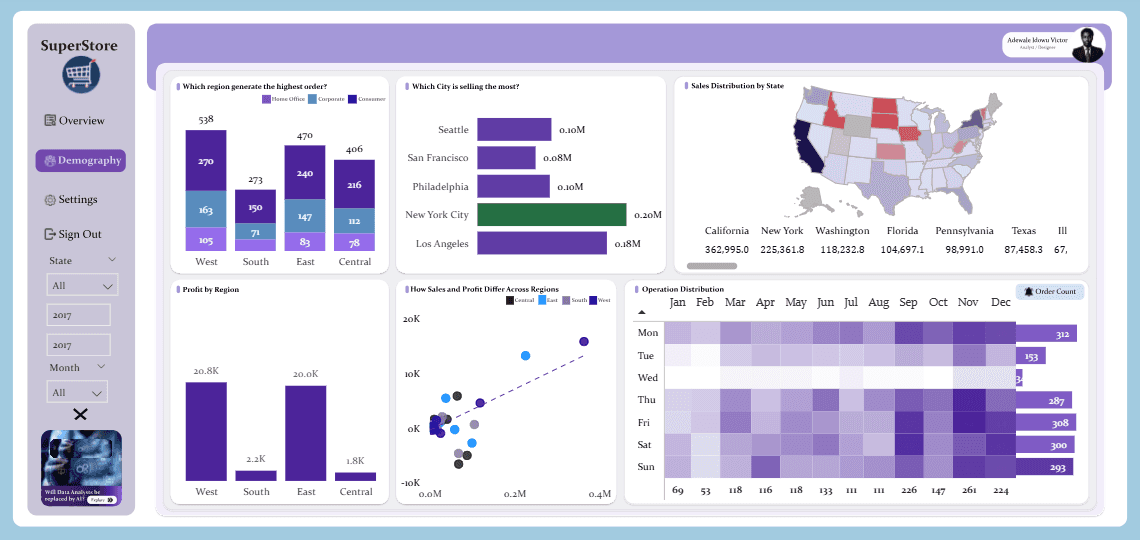

Visualization and Segmentation: The final model was visualized across interactive dashboards, segmenting performance across time, geography, and product category to facilitate the rapid identification of growth drivers and risk areas.

Business Questions

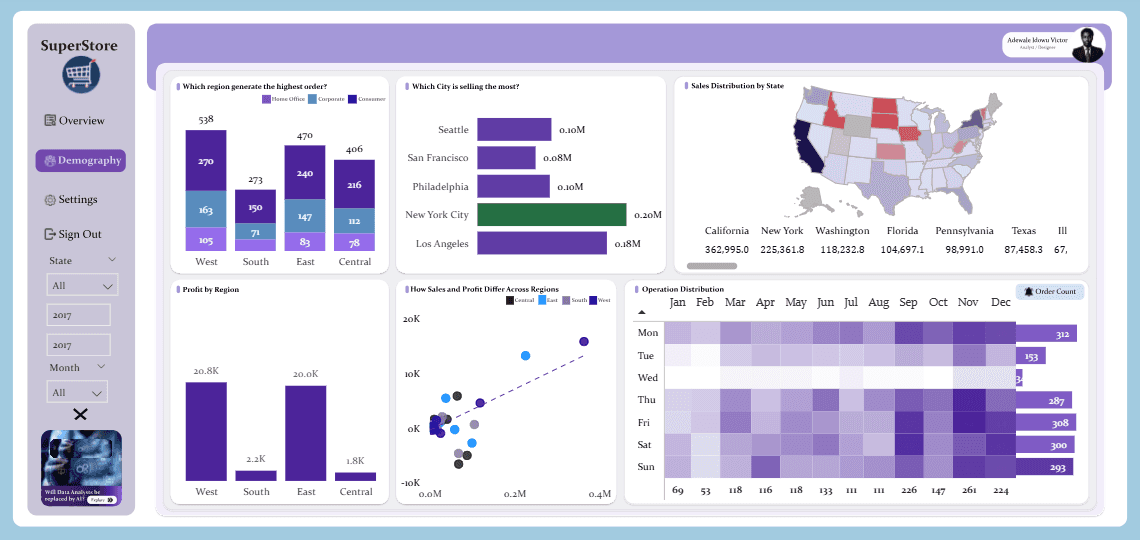

Which regions, states, and cities contribute most to revenue and profit?

Which areas are responsible for losses or low profitability?

Is there a relationship between sales and profit across states?

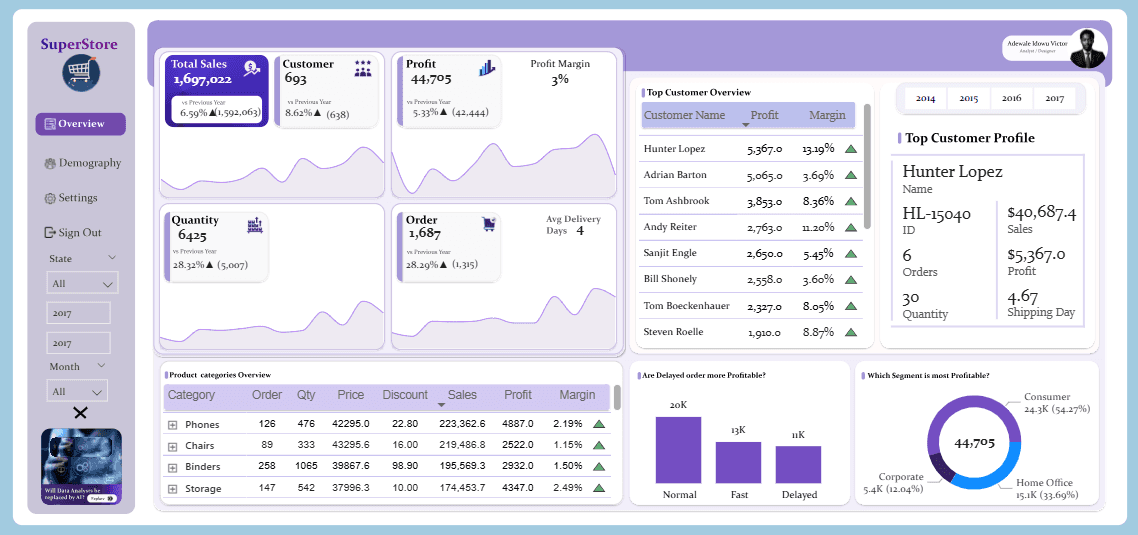

Who are the most valuable customers?

Which market segments are the most profitable?

What operational patterns exist across months and weekdays?

What strategic improvements can increase profitability and efficiency?

Objectives

Performance Evaluation & Growth Validation: Factually confirm the scale and balance of growth, especially the 28% surge in order volume and unit quantity.

Profit Optimization & Risk Management: Locate specific risk areas (low-margin products like Chairs) and identify profit leakage across regions.

Strategic Decision Support: Pinpoint the highest-value segments (Consumer) and dominant geographical regions (West/East) to guide resource allocation and market expansion.

Operational Improvement: Quantify logistical metrics (4-day Average Delivery) and analyze demand seasonality to optimize inventory and fulfillment processes.

Key Insights and Findings

· Growth & Financial Metrics (CY vs. PY)

Volume Acceleration: Orders reached 1,687 (a 28.29% increase), and Quantity reached 6,425 (a 28.32% increase from PY).

Sales & Profit: Total Sales for the current year is $1,697,022 (a 6.59% increase from the PY). Total Profit was $44,705 (a 5.33% increase from PY).

Margin Lag: The Profit Margin is 3%. Profit growth (5.33%) from PY lags behind both Sales and Volume growth, confirming that rising costs or aggressive discounting are compressing margins during expansion.

· Profit Drivers and Risks

Profit Engine: The Consumer segment is the most profitable, contributing 54.27% ($24.3K) of the total profit.

Top Customer (All Years): Hunter Lopez is the highest-value customer with $5,367 in profit, providing a reliable target for long-term retention.

High-Volume Risk: Phones generate the highest sales volume ($223.4K) in 2017 but yield a critical 2.19% profit margin.

· Diagnostic Analysis (Scatter Plot & Correlation)

Scatter Plot Insight: The scatter plot shows a weak positive correlation between sales and profit across regions. While higher sales slightly align with higher profit, most data points cluster near zero profit, indicating that many products generate strong sales but minimal or negative profit.

Profit–Sales Mismatch: The tight clustering near the midline suggests profitability is influenced by factors beyond sales volume, such as discounting, product mix, shipping cost, or regional cost structures. Sales alone do not guarantee strong profit performance.

· Geographical and Operational Facts

Regional Dominance: The West ($20.8K) and East ($20.0K) regions are the primary profit contributors, generating over 90% of the total profit.

Central Region: The Central Region's data points cluster in low-profit/loss-making zones on the scatter plot and contribute only $1.8K to total profit.

Operational Strain: The average delivery time is 4 days.

A significant volume of orders are categorized as 'Delayed,' which contributes less efficiently to profit ($11K) compared to Normal ($20K) and Fast ($13K) orders.

Seasonal Peaks: Demand spikes majorly during the festive/holiday months, with peak ordering seen in September, October, November, and December. Busiest days of the week include Friday, Saturday, Sunday, and Monday, indicating high weekend logistical strain.

Recommendations

The strategy must shift immediately to profit realization while sustaining volume growth:

Mandatory Chair Margin Intervention: Immediately review the cost structure and pricing of the Chairs category to raise its 1.15% margin, targeting a minimum of 4%. This is the highest priority margin intervention, followed closely by Binders (1.50%). Failure to act will severely cap future profit.

Logistics Improvement Focus: Implement a project to reduce the proportion of "Delayed" orders and drive down the 4-day average delivery time. Concurrently, optimize inventory and fulfillment processes specifically for the seasonal peak months (Nov/Dec) and high-volume weekends (Fri-Mon).

Strategic Resource Allocation: Prioritize investment (marketing, staffing) in the high-profit Consumer segment and the dominant West/East regions.

Profitability Check on Central Region: Immediately investigate the Central Region, which is characterized by low sales and negative profit, to identify structural inefficiencies in discounting or shipping costs and either correct them or re-evaluate market presence.

Expected Impacts

These recommendations will lead to measurable improvements in profitability and operational stability:

Profit Margin Expansion: Correcting the low-margin product risk is expected to elevate the overall company Profit Margin above 3%, resulting in a profit growth rate significantly higher than the current 5.31%.

Customer Lifetime Value (CLV) Increase: Reduced delivery delays and strengthened retention programs are projected to result in a 5–7% increase in CLV and higher customer satisfaction.

Operational Efficiency: Seasonal inventory alignment and improved logistics are expected to lead to reduced stockouts and faster fulfillment during peak demand periods.

Superstore Operational Efficiency & Sales Performance Analysis

Superstore Operational Efficiency & Sales Performance Analysis

Superstore Operational Efficiency & Sales Performance Analysis

A data-driven review of profitability and supply chain efficiency.

A data-driven review of profitability and supply chain efficiency.

A data-driven review of profitability and supply chain efficiency.

Role

Supply Chain & Operations Analyst

Industry

Retail & E-Commerce

Duration

2 Weeks

Project Overview

The analysis provides a critical business intelligence snapshot of SuperStore’s current performance, focusing on the significant margin compression occurring during a period of high volume growth. The primary focus is comparing Current Year (CY) metrics against Previous Year (PY) to confirm the 28% surge in orders and units sold. The core financial mandate is profit optimization, as high sales volume is not translating efficiently into profit due to critically low margins in key categories (Chairs: 1.15%) and underlying logistic inefficiencies (4-day average delivery time).

Process, Steps, and Methodology

The visual dashboards were generated through a precise Business Intelligence workflow designed for comparative analysis:

Data Ingestion and Cleaning (Power Query): Raw transactional data was ingested, with Power Query (ETL) was used for robust data cleaning, standardization of formats, and preparation of fields for accurate aggregation.

Model Building and Calculation (DAX): A relational data model was established where all Key Performance Indicators (KPIs) and comparative metrics were calculated using DAX (Data Analysis Expressions). DAX enabled the precise calculation of year-over-year growth figures and the conditional logic for the CY vs. PY comparison.

Visualization and Segmentation: The final model was visualized across interactive dashboards, segmenting performance across time, geography, and product category to facilitate the rapid identification of growth drivers and risk areas.

Business Questions

Which regions, states, and cities contribute most to revenue and profit?

Which areas are responsible for losses or low profitability?

Is there a relationship between sales and profit across states?

Who are the most valuable customers?

Which market segments are the most profitable?

What operational patterns exist across months and weekdays?

What strategic improvements can increase profitability and efficiency?

Objectives

Performance Evaluation & Growth Validation: Factually confirm the scale and balance of growth, especially the 28% surge in order volume and unit quantity.

Profit Optimization & Risk Management: Locate specific risk areas (low-margin products like Chairs) and identify profit leakage across regions.

Strategic Decision Support: Pinpoint the highest-value segments (Consumer) and dominant geographical regions (West/East) to guide resource allocation and market expansion.

Operational Improvement: Quantify logistical metrics (4-day Average Delivery) and analyze demand seasonality to optimize inventory and fulfillment processes.

Key Insights and Findings

· Growth & Financial Metrics (CY vs. PY)

Volume Acceleration: Orders reached 1,687 (a 28.29% increase), and Quantity reached 6,425 (a 28.32% increase from PY).

Sales & Profit: Total Sales for the current year is $1,697,022 (a 6.59% increase from the PY). Total Profit was $44,705 (a 5.33% increase from PY).

Margin Lag: The Profit Margin is 3%. Profit growth (5.33%) from PY lags behind both Sales and Volume growth, confirming that rising costs or aggressive discounting are compressing margins during expansion.

· Profit Drivers and Risks

Profit Engine: The Consumer segment is the most profitable, contributing 54.27% ($24.3K) of the total profit.

Top Customer (All Years): Hunter Lopez is the highest-value customer with $5,367 in profit, providing a reliable target for long-term retention.

High-Volume Risk: Phones generate the highest sales volume ($223.4K) in 2017 but yield a critical 2.19% profit margin.

· Diagnostic Analysis (Scatter Plot & Correlation)

Scatter Plot Insight: The scatter plot shows a weak positive correlation between sales and profit across regions. While higher sales slightly align with higher profit, most data points cluster near zero profit, indicating that many products generate strong sales but minimal or negative profit.

Profit–Sales Mismatch: The tight clustering near the midline suggests profitability is influenced by factors beyond sales volume, such as discounting, product mix, shipping cost, or regional cost structures. Sales alone do not guarantee strong profit performance.

· Geographical and Operational Facts

Regional Dominance: The West ($20.8K) and East ($20.0K) regions are the primary profit contributors, generating over 90% of the total profit.

Central Region: The Central Region's data points cluster in low-profit/loss-making zones on the scatter plot and contribute only $1.8K to total profit.

Operational Strain: The average delivery time is 4 days.

A significant volume of orders are categorized as 'Delayed,' which contributes less efficiently to profit ($11K) compared to Normal ($20K) and Fast ($13K) orders.

Seasonal Peaks: Demand spikes majorly during the festive/holiday months, with peak ordering seen in September, October, November, and December. Busiest days of the week include Friday, Saturday, Sunday, and Monday, indicating high weekend logistical strain.

Recommendations

The strategy must shift immediately to profit realization while sustaining volume growth:

Mandatory Chair Margin Intervention: Immediately review the cost structure and pricing of the Chairs category to raise its 1.15% margin, targeting a minimum of 4%. This is the highest priority margin intervention, followed closely by Binders (1.50%). Failure to act will severely cap future profit.

Logistics Improvement Focus: Implement a project to reduce the proportion of "Delayed" orders and drive down the 4-day average delivery time. Concurrently, optimize inventory and fulfillment processes specifically for the seasonal peak months (Nov/Dec) and high-volume weekends (Fri-Mon).

Strategic Resource Allocation: Prioritize investment (marketing, staffing) in the high-profit Consumer segment and the dominant West/East regions.

Profitability Check on Central Region: Immediately investigate the Central Region, which is characterized by low sales and negative profit, to identify structural inefficiencies in discounting or shipping costs and either correct them or re-evaluate market presence.

Expected Impacts

These recommendations will lead to measurable improvements in profitability and operational stability:

Profit Margin Expansion: Correcting the low-margin product risk is expected to elevate the overall company Profit Margin above 3%, resulting in a profit growth rate significantly higher than the current 5.31%.

Customer Lifetime Value (CLV) Increase: Reduced delivery delays and strengthened retention programs are projected to result in a 5–7% increase in CLV and higher customer satisfaction.

Operational Efficiency: Seasonal inventory alignment and improved logistics are expected to lead to reduced stockouts and faster fulfillment during peak demand periods.

View Document

Metro Bank Analytics

Metro Bank Analytics

A Customer Experience and Risk Audit

A Customer Experience and Risk Audit

Personal Finance Tracker

Personal Finance Tracker

Summary of Incomes, Savings and Expenses Insight

Summary of Incomes, Savings and Expenses Insight

J&SONS FARM Sales Analysis

J&SONS FARM Sales Analysis

Implementing data-driven improvements

Implementing data-driven improvements

Digital Marketing Campaign Analysis

Digital Marketing Campaign Analysis

Analyzing February 2025 Campaigns to Maximize Profitability and Conversion

Analyzing February 2025 Campaigns to Maximize Profitability and Conversion

U.S. Population Dashboard (1950–2015)

U.S. Population Dashboard (1950–2015)

Demographic Trends for Healthcare Planning

Demographic Trends for Healthcare Planning

London Short-Let Market Analysis

London Short-Let Market Analysis

Uncovering Pricing, Host Behavior, and Market Opportunities Across 68K Property Listings

Uncovering Pricing, Host Behavior, and Market Opportunities Across 68K Property Listings

Telecom Customer Churn Analysis

Telecom Customer Churn Analysis

Identifying Churn Drivers and Revenue Risks to Improve Retention Strategy

Identifying Churn Drivers and Revenue Risks to Improve Retention Strategy

Product Sales Performance Dashboard

Product Sales Performance Dashboard

Identifying Revenue Drivers, Low-Margin Products, and Seasonal Trends Across SKUs

Identifying Revenue Drivers, Low-Margin Products, and Seasonal Trends Across SKUs

Customer Order Performance

Customer Order Performance

Optimizing Conversion, Segment Strategy, and Seasonal Sales Across Markets

Optimizing Conversion, Segment Strategy, and Seasonal Sales Across Markets